Admittedly, when a person secures Insurance Policy he makes certain payments from time to time as per the schedule from his pocket and on the maturity of Policy in his lifetime, he is entitled to receive the same. Moreover, as per sub-Section 02 of Section 72 of Ordinance ibid the Policy holder can change the nominee or cancel the nomination at any time before maturity of the policy. It is further provided in the sub-section 05 of Section 72 of the Ordinance ibid that in the event of death of the nominee or the nominees before the policy matures the amounts secured by the policy shall be payable to the legal heirs of the deceased policy holder or legal representatives, or the holder of a succession certificate, as the case may be. It is nowhere mentioned that after the death of nominee the amount would be disbursed amongst the legal heirs or legal representatives of the nominee. Hence, it clarifies that the nomination shall not operate as a gift or will because had the nomination been a gift or will, then after the death of the nominee the amount (naeem)would devolve on the heirs of nominee rather than the heirs of policy holder.

انشورنس پالیسی کی رقم "ترکہ" شمار ہوتی ہے اور متوفی پالیسی ہولڈر کے تمام قانونی ورثا اسکے حقدار ہیں

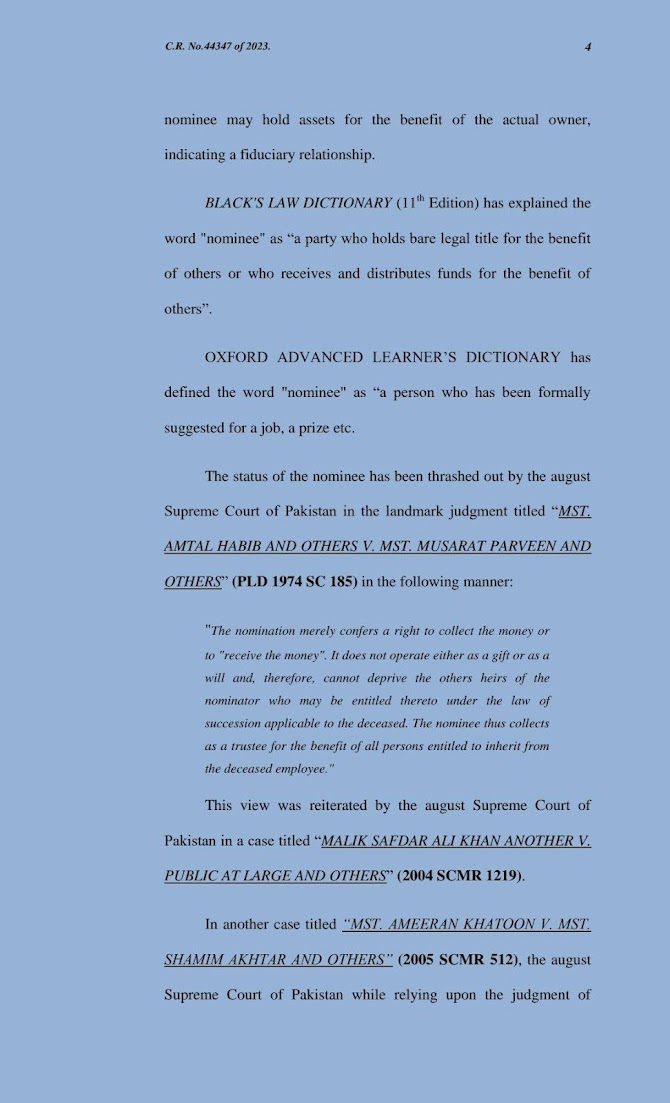

Case Laws

October 15, 2024

The Section 72 of the Ordinance ibid, authorizes and empowers the policy holder to nominate a person or persons to whom the money secured by the policy shall be paid in the event of his death, but this provision of law does not exclude the legal heirs to inherit the assets, including the policy proceed of the deceased according to the principle of Muhammadan Law, because the reasons is that there is a constitutional guarantee enunciated in the Constitution of the Islamic Republic of Pakistan, 1973, that no law can be made which is contrary to the injunctions of Quran and Sunnah. It is a Quranic injunction that the legal heirs of a Muslim deceased, will inherit their assets according to the principle of Muhammadan Law, therefore, for this reason the Superior Courts of the country finally held, (naeem)that the nominee is only supposed to collect the policy proceeds and to disburse among the legal heirs and further the nominee in any case shall not exclude or deprive the legal heirs by the fruits of the policy.

From the analysis of the above discussed legal provisions, it can be securely held that the Insurance Policy proceeds fall within the definition of 'Tarka' of the policy holder after his death.

The concept of nominee is alien to Muslim Law, according to which the legal heirs are the only persons entitled to receive the property left by their predecessor and no Muslim heir can exclude the other heir on the ground that he is a nominee. It is an established principle of law that a nominee, if appointed, does not become the sole owner of the assets (naeem)left by the deceased but he/she is only authorized to collect the amount or to hold the property of the deceased as an administrator and then to distribute the same amongst all the legal heirs. The nomination does not make the nominee as donee nor the nomination amounts to a gift, in the absence of delivery of possession of the property gifted. The nominee cannot claim as exclusive owner of the amount of the insurance policy. In the light of Muslim Law of Inheritance, all the legal heirs of the deceased are entitled to receive the property („Tarka‟) left by the deceased, according to their shares.

Civil Revision 44347/23

Blog Archive

Case Law Search

About Me

About

Subscribe Us

Ad Space

Popular Posts

Labels

Tags

- 0. XXII

- 0.XXXIII

- 11 CPC

- 115 CPC

- 144 CPC

- 148 CPC

- 149 CPC

- 151 CPC

- 1877 (I of 1877)

- 1908

- 1910

- 1962

- 1967(XVII of 1967)

- 2012 (IV of 2012)

- 2014 (XX of 2014

- 21 CPC

- 23 CPC

- 24 CPC

- 36 CPC

- 39 CPC

- 42 CPC

- 5 CPC

- 52 CPC

- 67 CPC

- 77 CPC

- 87 QSO

- 9 CPC

- Amendment

- APPEALS REVISION

- Banking Companies Ordinance

- C.P.C.

- Cas

- Case Law with Complete Judgment

- Case Laws

- Civil Procedure Code (V of 1908)

- CONVERSION OF WTITS

- CPC

- CPC 88

- Defamation Ordinance (LVI of 2002)

- Document

- Draft/Application

- Duty of Court

- Electricity Act

- Fraud

- Gift

- Important Judgment

- Inherit

- Inheritance

- Islamic Law

- Limitation Act

- limitation Laws Art. 163

- Must read judgement

- New ORDINANCE

- O-1 R-10

- O. XXI

- O. XXXIII

- O.1X

- O.IX

- O.IX R.13

- O.V

- O.VII

- O.VII R.11

- O.XI Rr.14 & 16

- O.XI Rr.14 & 21

- O.XL R. 1

- O.XX R.4

- O.XXXIV .R.5

- O.XXXIX

- Oder VII Rule 11d

- Oral Gift

- ORDER 37 – RULE 1&2

- Order 9 Rule 4

- Order XXV Rule 1

- Order-14

- Order-21

- Order-39

- Order. VII Rule.11

- PLD 2021 BALOCHISTAN 172

- Pleadings

- Pre-emption Act (1 of 1913)

- Punjab Overseas Commission Act

- Punjab Partition of Immovable Property Act

- QSO 79

- R . 11

- R 0. XXXIX

- R-4-A

- R. 10

- R. 8

- R.11

- R.13

- R.5

- R.6

- Rent

- Rent premises Act 2009

- Rr. 1 & 2

- Rr. 1 &2

- Rr. 15

- Rr. 5

- Rr. 7

- Rr. 97 to 103

- Rule 10

- Rule-1 & 2

- Rule-11

- Rule-2.

- Rules. 6 & 13

- SECOND APPEAL INTO REVISION

- SECTION 115

- SECTION 115.

- SECTION 12(2)

- SECTION 144 CPC

- Section 15

- SECTION 151

- SECTION 151.

- Section 17

- Section 18

- SECTION 9; O-7 R-11; BANKING ORDINANCE 1979 Sec 6(1) & (4)

- Section. 27

- SECTIONS 35 & 35-A C.P.C.

- Sind Rented Premises Ordinance (XVII of 1979)

- Sindh Rented Premises Ordinance (XVII of 1979)

- Specific Relief Act

- Specific Relief Act (I of 1877)

- Ss. 39 & 52.

- Suit

- Talk of the town

- Topic

- Transfer of Property Act (IV of 1882)

- Video

- VII

- W.P. Land Revenue Act

- West Pakistan Family Courts Act (XXXV of 1964)

- West Pakistan Land Revenue Act (XVII of 1967)

- West PakistanLand Revenue Act (XVII of 1967)

- West Punjab Muslim Personal Law (Shariat) Application Act (IX of 1948)

Popular Posts

Labels

Menu Footer Widget

Created By Blogger Template | Distributed By Gooyaabi Template

0 Comments